Comprehensive Valuation Reports

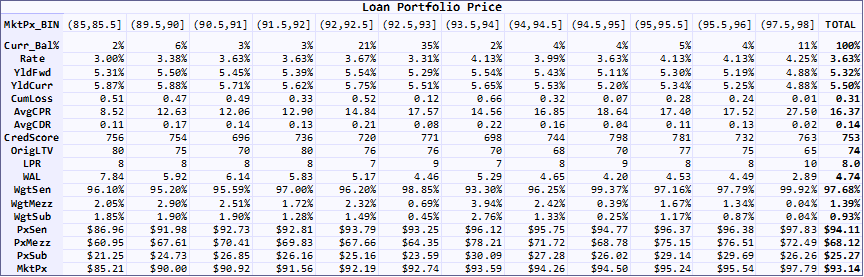

LoanKinetics generates many reports at the loan and portfolio level. The following report illustrates alternative valuation metrics, projected borrower behavior measures such as prepayments and defaults, credit characteristics, as well as AD&Co’s proprietary Loan Profile Ranking (LPR). Users may also see the breakdown of each loan into its senior, mezzanine, and subordinate components, as well as the value that is assigned to each component.